Market Conditions Start To Heat Up

- T. Livingston

- Jun 24, 2025

- 2 min read

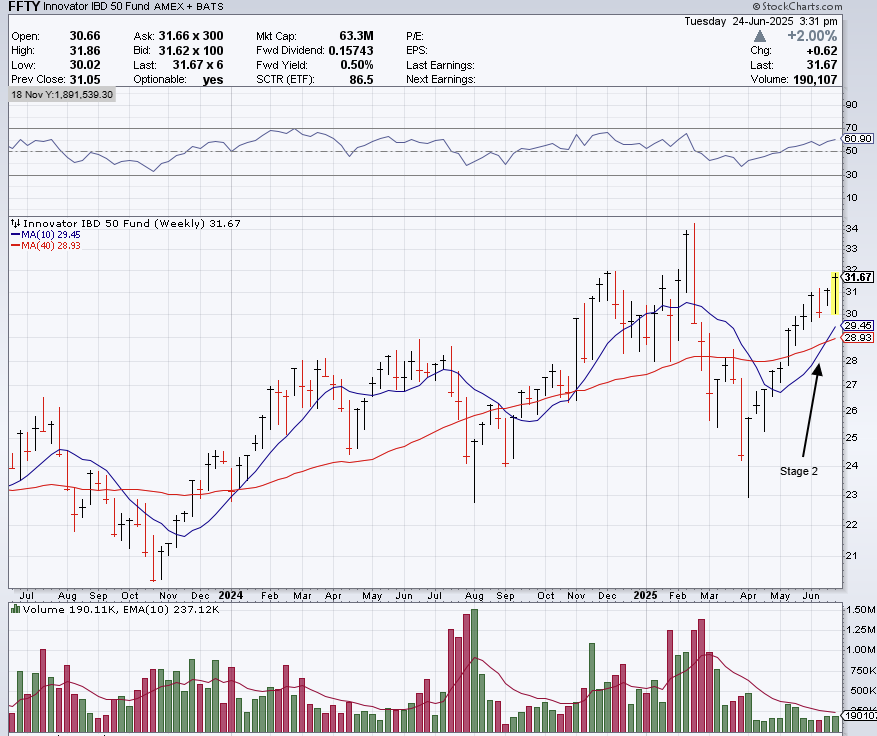

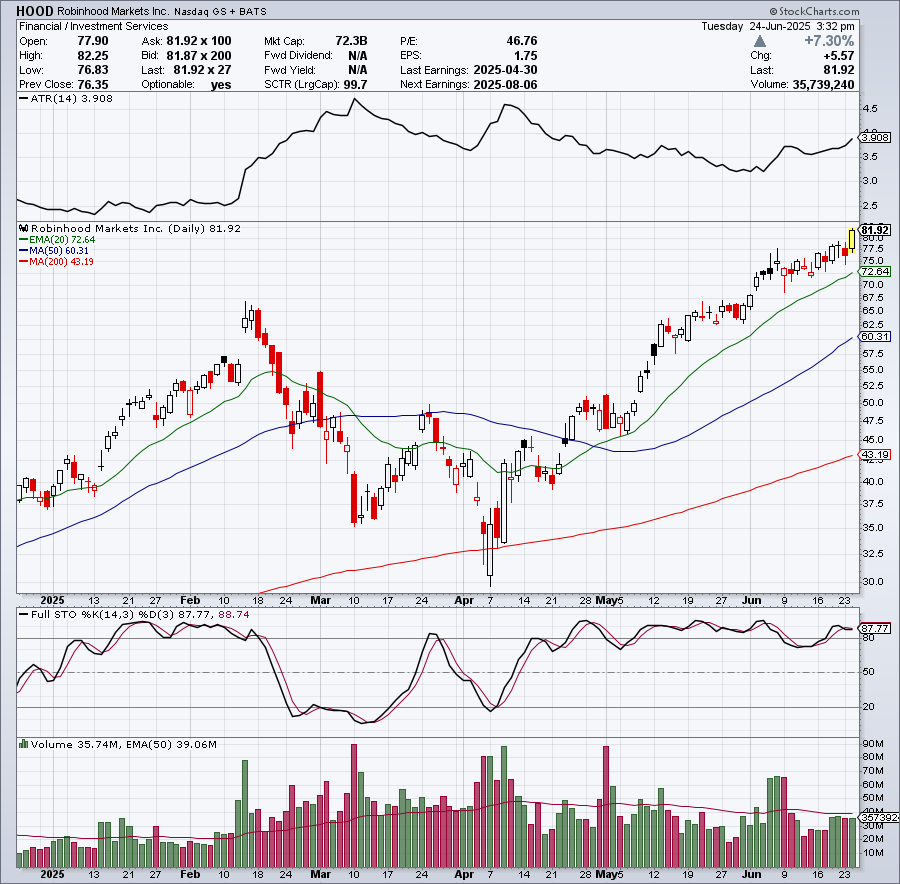

Market conditions continue to heat up, and it looks like a strong rally is beginning to emerge. With all the bad news over the last week, from Trump threatening to fire Jerome Powell, to the US strikes on Iran, you'd think the market would cave in. In fact, it's been the exact opposite. Leading names like PLTR and HOOD continue to trend higher. Furthermore, the Nasdaq and SP 500 are both closing in on new highs. This is an excellent sign given all the negative headlines. We are setting up in one of my favorite environments- that is a market were sentiment is bearish, the news is terrible, and yet leading stocks continue to blast higher and many indexes are showing strength. While the Russell 2000 has lagged, it, the IWO, and FFTY are all starting to move now.

As you can see on the charts below, SPY and the Nasdaq Composite look to be starting a new stage 2 uptrend. This is the optimum time to buy. To capture some of this momentum, I took a position in TQQQ today with a stop below recent support to limit my risk.

Risk right. Sit tight.

Full Disclosure: I currently own SPY, QQQ, TQQQ, HOOD, and PLTR.

Disclaimer: This information is issued solely for informational and educational purposes and does not constitute an offer to sell or a solicitation of an offer to buy securities. None of the information contained in this post constitutes a recommendation that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. From time to time, the content creator or its affiliates may hold positions or other interests in securities mentioned in this blog or the associated Twitter and Instagram feeds. The stock or stocks presented are not to be considered a recommendation to buy any stock or stocks. This material does not take into account your particular investment objectives. Investors should consult their own financial or investment adviser before trading or acting upon any information provided. Past performance is not indicative of future results.

Comments